Inflation is an economic concept that refers to increases in the price level of goods over a set period of time. The rise in the price level signifies that the currency in a given economy loses purchasing power (i.e., less can be bought with the same amount of money). Under ASC 842, those balances are no longer on the balance sheet but are reflected as adjustments to the ROU asset balance. Fixed assets, on the other hand, also known as noncurrent assets, hard assets or long-term assets are not as liquid as current assets.

Prepaid rent accounting

Prepaid rent is rent that’s been paid in advance of the period for which it’s due. Under ASC 842, the concept of prepaid rent does not exist; however, in practice it is common for lessees to make rent payments in advance. This means that paying attention to when prepaid rent is paid and ensuring it’s recorded correctly is of paramount importance.

Financial reporting and disclosures- common accounting issues for prepaid rent

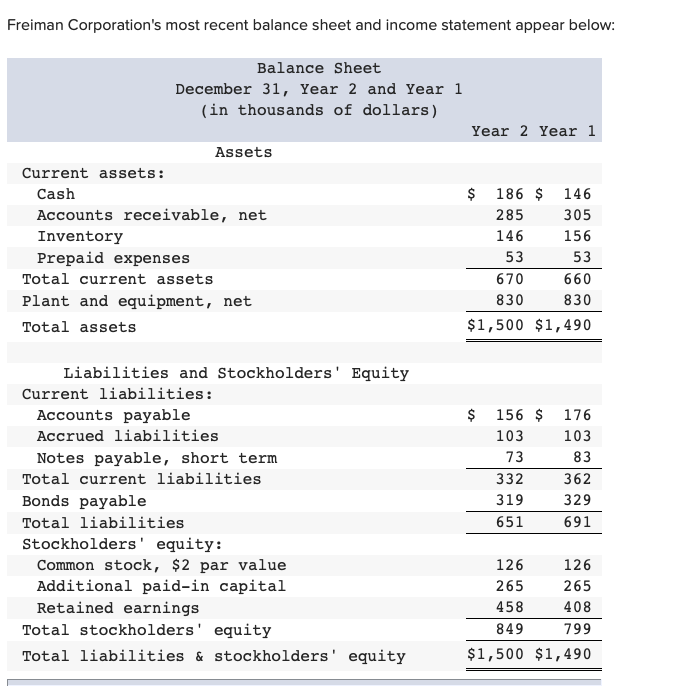

The period of non-current assets usually expands from 2 years to 10 years or more. Property, plant, equipment, and fixed assets are part of the long-term assets. Both assets and liabilities are recorded in an entity’s balance sheet and represent a company’s financial health snapshot. Common examples of prepaid expenses prepaid rent assets or liabilities include leases, rent, legal retainers, advertising costs, estimated taxes, insurance, salaries, and leased office equipment. Each month, an adjusting entry will be made to expense $10,000 (1/12 of the prepaid amount) to the income statement through a credit to prepaid insurance and a debit to insurance expense.

Accrued Rent Accounting under ASC 842 Explained

As the rent is recognized as an expense, the asset is decreased, and the rent expense is increased on the income statement. However, the cash flow statement will show cash outflow against operating activities. Besides, the prepaid rent is recorded as a current asset on the company’s balance sheet. Although prepaid expenses are initially recorded as assets, their value is expensed over time onto the income statement. Unlike conventional expenses, businesses tend to receive something of value from the prepaid expense over the course of several accounting periods.

- This is the more common payment arrangement, where tenants deliver their rent at the end of each period, such as monthly or quarterly.

- This was beneficial to lessees in that the obligation for those payments did not drive up the liability balance.

- All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly.

- We hope you will be able to identify the prepaid rent as an asset or liability in the financial statements of an entity.

- Failure to classify prepaids accurately on the balance sheet can lead to material misstatements of financial information and poor business decision-making.

- It also provides future benefits, as the landlord will apply the charge towards the upcoming rental period or periods.

An example of accounting for variable/contingent rent

At the same time, the credit creates a liability with the use of the revenue in advance current liability account. If you would like more information on income received in advance (often called unearned revenue), check out our tutorial here. In the accrual basis of accounting, the expenses and revenues are recorded in the books when they are incurred or earned irrespective of the cash has been paid or received. Per ASC 842, the ROU asset is equal to the lease liability calculated in step 3 above, adjusted by deferred or prepaid rent and lease incentives. In this example, it is the liability of $11,254,351 minus the incentive balance of $200,000. A retailer enters into a 10-year warehouse lease with initial rent payments of $120,000 a month and a 2% annual rent escalation.

Prepaid rent is the amount the company pays in advance to use the rental facility (e.g. office or equipemnt, etc.). Hence, the company needs to properly make the prepaid rent journal entry to avoid the error that leads to misstatement due to prepaid rent is not appropriately recognized in accounting. Consider an example where the present value (PV) of lease payments, excluding the prepaid amount, is $8,000, and the prepaid rent is $2,000. In this case, the lease liability recognized is $8,000, and the Right-of-Use Asset balance totals $10,000 ($8,000 lease liability + $2,000 prepaid).

Therefore, when a company prepays for an expense, it is recognized as a prepaid asset on the balance sheet. The entry of this prepaid expense amount is done with a simultaneous entry being recorded that reduces the company’s cash or payment account by the same amount. The majority of prepaid expenses appear on the company’s balance sheet as a current asset except the expense is not to be incurred until after 12 months, which is actually rare. A company can make an advance payment for a good or service such as rent for leased office space or insurance coverage that gives continual benefits over time.

Common examples include rent, insurance, leased equipment, advertising, legal retainers, and estimated taxes. In business, prepaid expenses are recorded as assets on the balance sheet because they represent future benefits, but they are expensed at the time when those benefits are realized. The balance sheet must accurately reflect this asset to provide a clear picture of the company’s financial position.

An asset is a resource that has economic value, and you expect it to provide future benefits to the owner. There are different types of investments, including current assets and long-term assets. Prepaid rent is a financial concept that plays a crucial role in the accounting and management of an apartment’s rent payments, both from the perspectives of landlords and renters. This article delves into the intricacies of prepaid rent, its accounting treatment, and its implications on financial statements.

Now that we have established that prepaid rent can be considered an asset, it is vital to understand how you account for it in financial statements. The amount of the charge increases the prepaid rent asset account, and the same amount decreases the cash account. Nevertheless, differences between lease expense and lease payments also exist under ASC 842. This comparison of deferred rent treatment under ASC 840 and ASC 842 is illustrated in Deferred Rent Accounting and Tax Impact under ASC 842 and 840 Explained. If, for example, the space was used as a place to manufacture goods, the expense would then be listed as part of the cost of goods sold for the products produced.